How to buy a home in a warming world

Buying a home is one of the biggest choices you’ll ever make.

Bundled in that one decision is a thousand factors that define your life. Your community, your bills, and who you’ll depend on in an emergency. In a changing climate, house buying comes with new risks.

Climate change might feel far away, but it’s affecting us now. The seas might not eat the shore for decades, but pollution-powered floods and storms are already destroying Kiwi homes.

We bought a house this year and all this was swimming through my mind. What risks should we consider? Which homes are safer in a warming world?

The Ministry for the Environment estimates that nearly 15,000 homes across the motu could be seriously damaged by storm surges or floods by 2060. The repair bill could be around $4.8b. We don’t know that for sure, though. It could be anything from $1.8b to $12.9b.

In the first of a two part series, I want to delve into climate and housing. Then, we’ll explore how our housing choices can solve the pollution problem. Today, we’re going to learn about what you should look out for if you’re looking to buy.

High temperature living

It was a muggy afternoon at a Mount Cook open home. Early on, I asked the real estate agent if it was possible to install a heat pump. She replied that we shouldn’t worry, because the place got quite warm.

That’s what I worried about – heat waves. After a year living in an overheated apartment, we didn’t want to risk heat exhaustion in sweltering summers. Heat pumps are a fantastic way to keep cool.

She retorted with a patronising tone. “You know we’re in Wellington, right?”

Wellington’s summers will continue getting warmer. It’s important to have somewhere that stays cool. We… didn’t buy from that real estate agent.

It’s unnerving how many in property have no knowledge or interest in how a warming world affects their product.

Like I covered last year, many townhouses and apartments are poorly designed for hotter summers. Badly designed homes trap heat and bodycorps can flat out deny owners from installing a heat pump.

Whenever we looked at a house, we always checked how easy it was to heat and cool. We always asked:

- How hot does it get here in summer?

- What’s the body corporate process for installing a heat pump?

- What’s the ventilation like?

The uncertainty of natural hazards

Many real estate agents know the earthquake risk of a house like the back of their hand. It’s harder to get information about disaster risk from storms, floods, and slips.

Wellington’s geography means there are many risks to consider. In Lyall Bay, some homes are low lying and at risk of storm surges. Some places in Tawa are vulnerable to extreme flooding. Homes on our steep hills could slip in a downpour.

To get some broad idea on risky areas, Greater Wellington offers a map which shows which areas are vulnerable to natural hazards. Unfortunately, it’s hard for normal people to understand. Seriously, who is expected to understand the meaning of a 0.23% AEP flood? (It means once in a 440 year flood. Now you know!)

Without clear insights for people seeking to buy, it’s easy to fall into being way too chill about it or crashing out. More home buyers need to have easy ways to know the risk and understand what those risks mean.

People have different risk tolerances. The main thing we avoided was flood prone areas. To gauge the risk, we always checked:

- local flood maps

- storm surge maps

- sea level elevation.

The hazard of insurance

Most banks won’t give you a mortgage without house insurance. As the climate changes, so does the math on whether a house is worth insuring. The risk of disasters is increasing, which means that homes at greater risk of climate disaster will get more expensive to insure.

Tower Insurance is the first to respond to growing climate risk. They now decide the cost of content and home insurance based on how at risk your home is to natural hazards. A home might be a bargain because the insurance bill is eye-watering. Sometime soon, the most at risk homes could be refused insurance entirely.

At least 10,000 New Zealand homes in our biggest four cities sit in the once in a century flood zones alone. Some of those homes are in places like Tawa or Upper Hutt. It’s unclear how expensive it’ll get to insure them.

This is one of the constant challenges with a warming world. Things we understood as solid ground become quicksand. We, understandably, take for granted the foundations of a stable climate. We can’t assume it will stay the same any more.

To manage the risk of skyrocketing insurance, we checked:

- if there have been any insurance claims on the property before

- the cost of body corporate or insurance to see if there was something to be nervous about.

Why this all matters

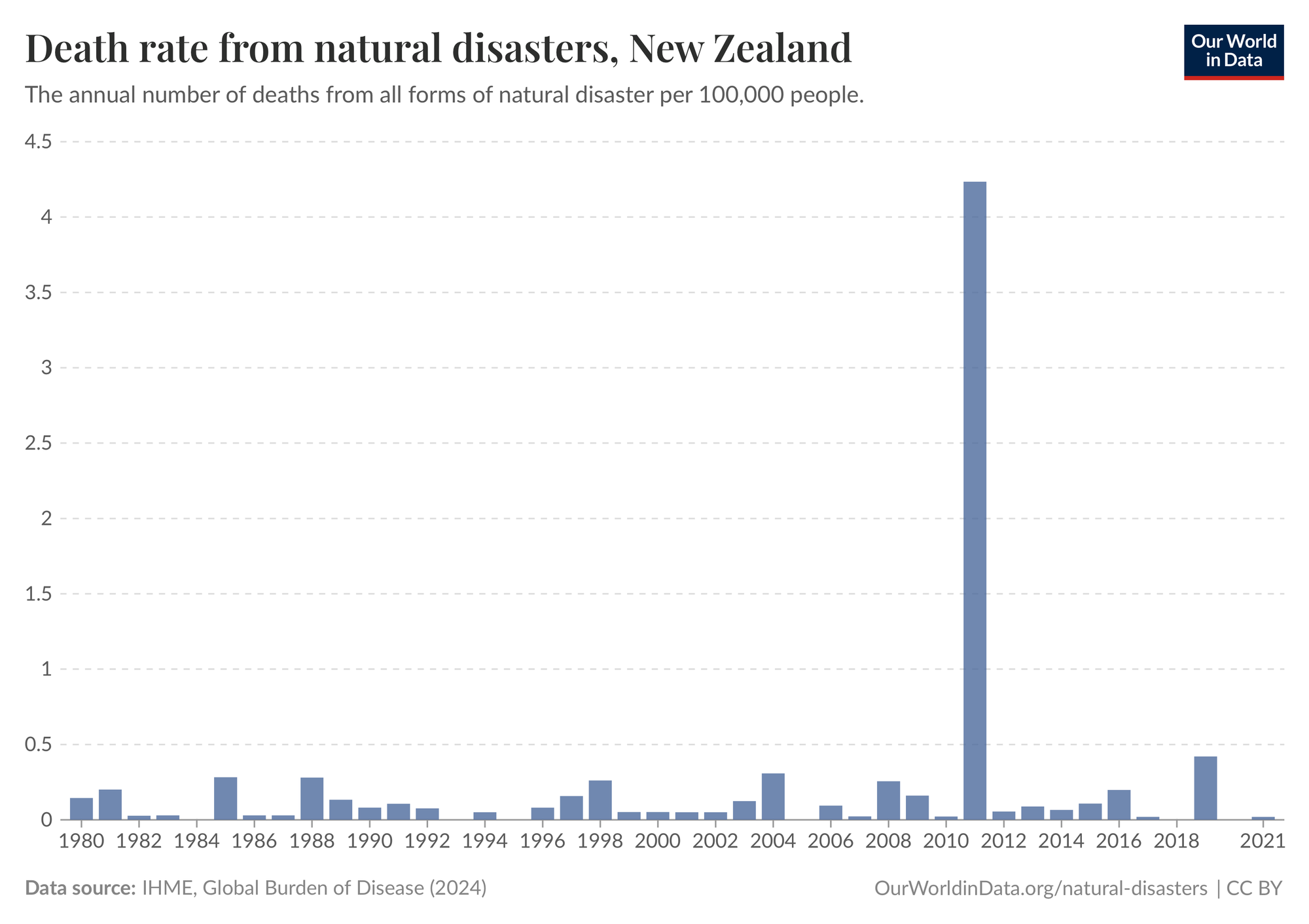

We live in a paradoxical world: even as our weather events become more chaotic, our disaster death rate remains remarkably low. Our improved emergency alerts and civil defence education probably make a huge difference.

Deaths from climate disaster are personally devastating. What gives me hope is that our emergency services have shown they can keep so many of us safe from volatile weather. What I’m far more nervous about is whether we’ll be able to protect some families’ livelihoods with the same effectiveness.

Many Kiwi families bet their fortune on housing. It’s common to use KiwiSaver to reach the 20% deposit to buy a house – missing out on hundreds of thousands in compound interest to have a secure place to lay down roots. Is that tradeoff worth it if they buy a climate risky home?

Imagine a young family who threw their entire KiwiSaver into their first home. If their house gets destroyed by a storm or flood, they’ve lost their biggest key to a comfortable retirement. There aren’t many who would buy the land, or loan them money to rebuild in a risky area.

When a big disaster like Gabrielle happens again, it’s not clear the Government will help. The Coalition is already making murmurs that they won’t offer recovery money forever. If a flood devastates the Wellington region, will the government shell out?

Without clear information, without many cheap options in safe areas, without a coordinated response from government to cut pollution or stop housing being built in risky areas – how do we fairly decide who loses their livelihoods to these disasters? When is it the responsibility of the system versus the individual?

I have no good answer to these questions. As a society, we need to decide what’s fair. In my view, we should also do everything we can to reduce the risk by polluting far less, far faster.

The most we could do as a couple house hunting was to know the risks and, more importantly, choose housing that can be part of the solution.

There are a thousand layers of uncertainty, but we’re not powerless. To protect the places we call home, we can choose to live differently.

By understanding the risks, you can do more than weather the storms. You can be empowered to live a fulfilling, low pollution life.

Next time, we’ll explore how instead of only worrying about our homes, we can use them to protect our place from a warming world.